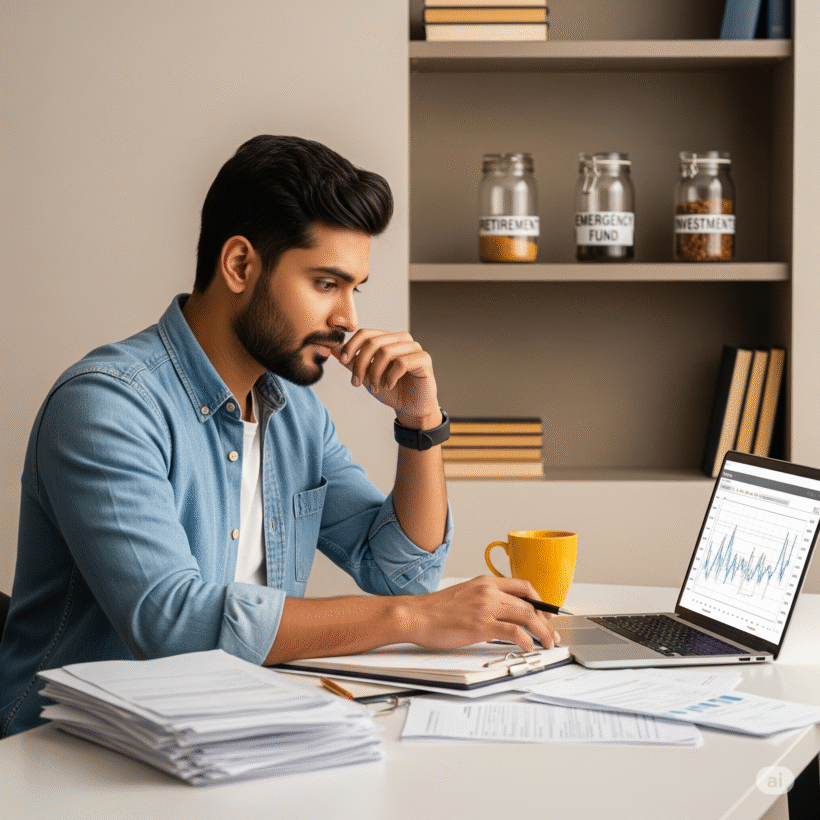

5 Biggest Financial Mistakes People Make in Their 30s

Your 30s are a financial turning point. This decade is when careers stabilize, responsibilities grow, and your money habits either build wealth — or lead to regret. Yet, many fall into avoidable traps. Let’s explore the five biggest financial mistakes people make in their 30s and how to steer clear of them.

1. Not Building an Emergency Fund

Most people ignore the importance of a financial cushion. When an unexpected event like job loss or medical bills hits, it throws life off balance.

“A rainy day will come — the wise save before the clouds appear.”

Why it’s a mistake:

Without an emergency fund, you may be forced to break investments or borrow at high interest.

Fix it:

Build a fund equal to 3–6 months of expenses. Use high-interest savings accounts or liquid funds.

Compare liquid funds | Emergency Fund Guide – ET Money

2. Delaying Investments

Many delay investing because they feel unprepared or think their income is too low.

“You don’t need to be rich to invest, you need to invest to become rich.”

Why it’s a mistake:

You lose the power of compounding — the longer your money works, the better your returns.

Fix it:

Start with SIPs in mutual funds or use public schemes like PPF.

How SIP Works | PPF Calculator – ClearTax

3. Lifestyle Inflation

As income grows, people often upgrade cars, homes, gadgets — without upgrading savings.

“Don’t upgrade your lifestyle before upgrading your savings.”

Why it’s a mistake:

Increased liabilities and EMIs can prevent wealth creation and trap you in debt.

Fix it:

Stick to a budget. Follow the 50-30-20 rule (50% needs, 30% wants, 20% savings).

Monthly Budgeting Guide – BankBazaar

4. Skipping Insurance Planning

Many think their corporate insurance is enough or don’t buy insurance assuming they’re healthy.

“Insurance is not for the living — it’s for the ones left behind.”

Why it’s a mistake:

Medical bills or untimely death can destroy your family’s financial security.

Fix it:

Buy term insurance (10–15× your annual income) and separate health cover.

Best Term Insurance Plans – Policybazaar | Health Insurance Guide – Max Life

5. Not Planning for Retirement

Retirement may feel far, but without a plan, you’ll find yourself short when it matters most.

“The best time to plant a tree was 20 years ago. The second best time is now.”

Why it’s a mistake:

EPF alone won’t meet future expenses. Inflation erodes purchasing power.

Fix it:

Start investing in long-term mutual funds or use the National Pension Scheme (NPS).

NPS Explained – NSDL | Top Retirement Mutual Funds – Morningstar India

Final Thoughts

Your 30s offer the most valuable currency of all — time. Avoiding these mistakes now will give you peace, freedom, and wealth later.

“Success in personal finance is not about income. It’s about discipline, direction, and delayed gratification.”