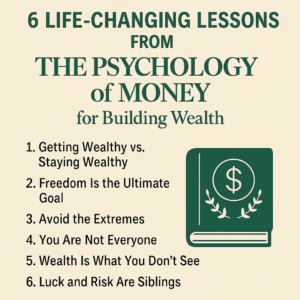

6 Life-Changing Lessons from The Psychology of Money for Building Wealth

Money isn’t just math. It’s emotions, habits, ego, and life decisions.

Morgan Housel, in The Psychology of Money, doesn’t give you formulas — he gives you timeless wisdom.

This book makes you rethink wealth — not just how to earn it, but how to keep it, grow it, and feel at peace with it.

Here are six powerful lessons, explained with relatable stories and easy-to-remember takeaways. These ideas can truly shift how you live and think about money.

Lesson 1: Getting Wealthy vs. Staying Wealthy

The Story:

Rick worked hard in his 30s. He built a business and made smart stock picks.

By 40, he had $2 million. But it wasn’t enough.

He borrowed more, chased risky gains, and lived large. Then the market crashed. His investments tanked.

He had loans but no cushion. Rick lost almost everything.

The Takeaway:

Getting wealthy often involves taking risks, being bold, and acting fast.

But staying wealthy? That’s about patience, humility, and protecting what you’ve built.

The most important financial skill is survival.

Don’t bet the house once you’ve won the game.

Preserve your wealth by being cautious, not greedy.

Even after success, always plan for the unexpected.

Lesson 2: Freedom Is the Ultimate Goal

The Story:

Maya had a dream job — big title, bigger pay.

But her calendar was always full. Her weekends were packed with meetings.

No vacations. No time for family.

She quit and built a small freelance practice. Her income dropped by 40%. But she chose her hours. She traveled. She smiled more.

The Takeaway:

Money is just a tool. The best thing it can buy is freedom.

Not designer bags. Not social media likes.

It should buy you time — time to think, time to rest, time to choose your day.

True wealth isn’t about what you own.

It’s about having control over how you spend your time.

Use money to build a life that feels free, not just busy.

Lesson 3: Avoid the Extremes

The Story:

Sam was a super saver. He saved 70% of his salary.

He never ate out. No parties. No vacations. He lived like a monk.

He was proud. But he was also tired. Lonely.

One day, he fell ill. The doctor blamed stress and lack of balance.

Sam realized he saved for a future he wasn’t even enjoying.

The Takeaway:

Saving is great. But over-saving can starve your present for the sake of an uncertain future.

Wealth is not about sacrifice alone. It’s also about enjoying what you earn — today.

Strike a balance.

Don’t let frugality rob you of joy.

Spend wisely. But also live meaningfully.

The goal is not just financial security — it’s also emotional well-being.

Lesson 4: You Are Not Everyone

The Story:

Nina heard everyone was investing in a hot new crypto.

She didn’t want to miss out.

She bought at a peak. Weeks later, the market crashed. She panicked.

Later, she realized those people were day traders. She wanted long-term growth. They wanted fast wins.

The Takeaway:

You can’t win someone else’s game.

Everyone has different goals, timelines, and tolerances.

If you follow the crowd without knowing why, you might end up in the wrong place.

Make money moves that match your values, your needs, and your goals.

Comparison is dangerous. Focus on your journey.

Your financial strategy should reflect your unique life path.

Lesson 5: Wealth Is What You Don’t See

The Story:

John had it all — flashy cars, branded clothes, big house.

People envied him. But behind the scenes, he had debt.

Every paycheck went toward EMIs.

Then he met Arjun, a school friend. Arjun lived simply. No loans. A solid savings account.

Arjun had peace. John had stress.

The Takeaway:

True wealth is invisible.

It’s the money you didn’t spend. It’s the debt you avoided.

It’s the peace of knowing you’re secure, even if no one claps for you.

Many people look rich. Few actually are.

Don’t try to impress others — invest in your future instead.

Financial freedom comes from silence, not applause.

Lesson 6: Luck and Risk Are Siblings

The Story:

Lily started a business and did well.

She was praised for her talent and hustle.

Tara, her friend, did the same — same business, same effort. But a flood ruined Tara’s stock.

She failed. Not from laziness, but from bad luck.

The Takeaway:

Success isn’t always earned. Failure isn’t always deserved.

Luck and risk are twins.

Sometimes you win because the wind was behind you.

Sometimes you fail even when you do everything right.

Stay humble.

Don’t judge people by outcome alone — not yourself, not others.

Learn to respect uncertainty and plan for it.

Preparation matters, but so does grace.

Buy from Amazon Psychology of Money

Final Thoughts

The Psychology of Money is more than a money book.

It’s a mindset book. It’s about how to think clearly in a world filled with noise.

These six lessons aren’t just for investors or CEOs.

They’re for anyone who wants to live with less stress and more meaning.

They teach us to be wise, not just rich.

You don’t need millions to feel wealthy.

You need clarity. You need patience. You need purpose.

Remember:

-

You win by protecting what you have.

-

You grow by learning every day.

-

You thrive by making money serve you — not the other way around.

Quick Summary Table

| Lesson | Core Message |

|---|---|

| 1. Getting vs. Staying Wealthy | Protect your gains. Survival is the ultimate skill. |

| 2. Freedom Over Fancy | Use money to buy time, not trophies. |

| 3. Avoid Extremes | Balance saving with living. Money is also for joy. |

| 4. Don’t Copy Others | Your financial path is personal. Don’t follow the herd. |

| 5. Wealth Is Hidden | True wealth is quiet. It’s in your savings. |

| 6. Respect Luck and Risk | Don’t judge outcomes. Stay humble and aware. |

A Word From Me

When I first read The Psychology of Money, I had savings.

But I was still anxious. Still chasing more. Still unsure why.

This book gave me a lens. It taught me to see wealth as a journey, not a scoreboard.

Now I sleep better. I think long-term. I no longer chase. I choose.

If you feel stuck, confused, or driven by fear — read this book.

Let it reset your compass. Let it simplify your path.

Let’s build real wealth — not just in our wallets, but in our minds.

Follow AJEXPLAINS for more such knowledge sharing articles.

Buy from Amazon Psychology of Money