Zomato vs Swiggy 2025: Who’s Winning the Food Tech Battle in India?

Two giants — Zomato and Swiggy — are leading this race and India’s food delivery industry is booming.. But their stories, strategies, and futures are very different.

Let’s dive into their journey, from founders to finances.

Founders with Big Dreams

Zomato began in 2008 as a restaurant listing site. It was founded by Deepinder Goyal, an IIT Delhi graduate. He later teamed up with Pankaj Chaddah.

Swiggy entered later, in 2014. It was the brainchild of Sriharsha Majety (IIM Calcutta), Nandan Reddy, and Rahul Jaimini (IIT Kharagpur). They built it with logistics as the backbone.

“Strong tech and business minds laid the foundation for both.”

Source – Wikipedia

Pan-India Presence of Zomato and Swiggy

Zomato is now available in over 800 Indian cities. Swiggy, slightly behind, operates in 500+ cities.

Both dominate metros. But Zomato has scaled deeper into tier-2 and tier-3 cities.

“Zomato’s wider reach gives it a logistics edge in smaller towns.”

Source – Inc42

What Else Do They Own?

Zomato is more than just food delivery.

It owns Blinkit, a fast-growing quick-commerce platform for groceries. It also runs Hyperpure, a supply chain for restaurants, and has acquired Paytm’s ticketing unit.

Swiggy isn’t far behind.

It runs Instamart (groceries), Dineout (restaurant reservations), and has entered event ticketing with Scenes.

“The next battleground is not food — it’s fast delivery and events.”

Employee Strength

As of early 2025:

-

Zomato has around 4,440 employees

-

Swiggy employs over 5,000 people

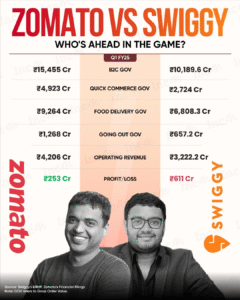

Money Talks: Financial Snapshot (2024-2025)

Zomato posted a Q4 profit of ₹39 crore, but that’s 78% lower than last year.

Blinkit’s revenue doubled to ₹1,709 crore, yet it made a loss of ₹178 crore.

Swiggy’s big moment came in November 2024.

It launched a massive ₹11,327 crore IPO, which was subscribed 3.59x. Shares rose 17% on debut, pushing Swiggy’s market cap to $12 billion.

IPO Overview – Groww

Listing Report – Reuters

Subscription Info – Business Standard

What’s Next (2025–2026)?

Zomato is focusing on food delivery growth and scaling Blinkit further. It expects Blinkit to break even by FY26.

Swiggy aims to reach EBITDA-level profitability by the end of FY26. It’s opening more Instamart dark stores and investing in tech and logistics.

“Both are racing toward sustainability, but through different lanes.”

So… Who’s Ahead?

Zomato is more diversified and profitable.

Swiggy is more aggressive and investor-backed.

If you want stable growth and food dominance — Zomato wins.

If you believe in fast expansion and IPO-driven scale — Swiggy has the edge.

Both are valuable. Your pick depends on your risk appetite.

Quick Recap

| Metric | Zomato | Swiggy |

|---|---|---|

| Cities | 800+ | 500+ |

| IPO | Done in 2021 | Done in 2024 |

| Grocery | Blinkit | Instamart |

| Q4 Profit | ₹39 Cr | Not yet profitable |

| Market Cap | ₹1.3L Cr (approx) | $12B (₹1L+ Cr) |

| Employees | 4,440 | 5,000+ |

Final Thought

India’s food war is now beyond food.

The real competition is in quick commerce, tech, and local dominance.

Watch both Zomato and Swiggy closely — they’re not just apps anymore, they’re ecosystems.