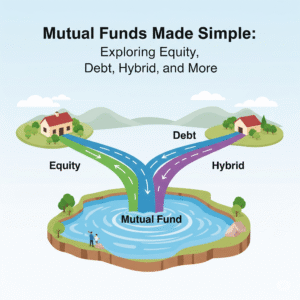

Understanding the Different Types of Mutual Funds in India

Mutual funds are one of the most accessible and flexible investment vehicles available today. They allow individuals to pool their money, which is then professionally managed and invested across various financial instruments based on the fund’s objective.

In India, mutual funds are classified based on where they invest—such as equity, debt, hybrid instruments, and more. Let’s explore each type of mutual fund, their subcategories, and key features in greater detail.

1. Equity Mutual Funds

Equity mutual funds invest primarily in stocks or equity-related instruments. They are designed to generate capital appreciation over the long term.

Subcategories of Equity Funds:

-

Large Cap Funds

-

Invest in the top 100 companies by market capitalization (like Reliance, TCS, Infosys).

-

These companies are considered stable, with a proven track record.

-

Lower risk than mid or small-cap funds.

-

-

Mid Cap Funds

-

Focus on 101st to 250th ranked companies by market capitalization.

-

Higher growth potential, but also more volatile than large-cap funds.

-

-

Small Cap Funds

-

Invest in companies beyond the top 250 market-cap list.

-

Suitable for long-term investors willing to take higher risks for potentially higher returns.

-

-

Multi Cap Funds

-

Diversified across large, mid, and small-cap companies.

-

Offer better balance and flexibility in various market cycles.

-

-

ELSS (Equity Linked Savings Scheme)

-

Offers Section 80C tax benefits up to ₹1.5 lakh per year.

-

Comes with a 3-year lock-in period.

-

Best for tax-saving with long-term growth.

-

-

Sector/Thematic Funds

-

Invest in specific sectors like pharma, banking, technology, or themes like ESG or Make in India.

-

Highly volatile and depend heavily on sectoral performance.

-

⭐ Key Features:

-

Suitable for long-term goals such as retirement, buying a house, or children’s education.

-

High return potential with high market volatility.

-

Requires patience and a high-risk appetite.

-

Returns are not guaranteed and fluctuate with market performance.

2. Debt Mutual Funds

Debt funds invest in fixed-income securities like government bonds, treasury bills, commercial papers, and certificates of deposit.

Subcategories of Debt Funds:

-

Liquid Funds

-

Invest in instruments maturing in up to 91 days.

-

Ideal for emergency corpus and short-term parking of funds.

-

-

Ultra Short Duration Funds

-

Invest in instruments with maturity between 3 to 6 months.

-

Slightly better returns than savings accounts.

-

-

Short Duration Funds

-

Invest in bonds maturing in 1 to 3 years.

-

Suitable for those with short to medium investment horizons.

-

-

Medium & Long Duration Funds

-

Invest in instruments with longer maturity periods.

-

Higher returns with higher interest rate risk.

-

-

Corporate Bond Funds

-

Invest in highly-rated corporate debt instruments.

-

Relatively stable with moderate returns.

-

-

Gilt Funds

-

Invest only in government securities (G-secs).

-

Virtually no credit risk, but sensitive to interest rate changes.

-

-

Fixed Maturity Plans (FMPs)

-

Closed-end funds that mature on a fixed date.

-

Tax-efficient and ideal for investors with a clear investment horizon.

-

⭐ Key Features:

-

Lower risk than equity funds but not risk-free.

-

Suitable for capital preservation and stable returns.

-

Ideal for short to medium-term goals like vacation planning or tuition payments.

-

Affected by interest rate fluctuations, not stock market movements.

3. Hybrid Mutual Funds

Hybrid funds combine both equity and debt instruments to create a balanced portfolio.

Subcategories of Hybrid Funds:

-

Aggressive Hybrid Funds

-

Invest 65–80% in equity and the rest in debt.

-

Designed for investors seeking growth with a cushion of safety.

-

Offer long-term growth with reduced volatility compared to pure equity.

-

-

Conservative Hybrid Funds

-

Allocate 75–90% in debt and the rest in equity.

-

Focused on capital preservation while generating slightly higher returns than debt-only funds.

-

-

Balanced Advantage Funds (Dynamic Asset Allocation)

-

Asset allocation between equity and debt changes dynamically based on market trends.

-

Suitable for investors who prefer automated rebalancing and reduced emotional bias.

-

-

Multi-Asset Allocation Funds

-

Invest in at least three asset classes (typically equity, debt, gold).

-

Designed to provide true diversification and lower portfolio risk.

-

⭐ Key Features:

-

Moderate-risk investment option.

-

Suitable for new investors or those transitioning from fixed deposits.

-

Benefit from market upside while limiting downside risk.

-

Good for medium-to-long-term goals.

4. Index Funds

Index funds replicate the performance of a market index like Nifty 50, Sensex, or Nifty Next 50.

⭐ Key Features:

-

Passively managed – minimal human intervention.

-

Lower expense ratio than active funds.

-

No fund manager bias or stock selection risk.

-

Suitable for investors seeking market-level returns over the long term.

⬛ 5. Exchange Traded Funds (ETFs)

ETFs are like index funds but listed on stock exchanges. They can be bought and sold like shares during market hours.

⭐ Key Features:

-

Real-time trading like stocks.

-

Lower cost structure.

-

Transparency of portfolio.

-

Ideal for savvy investors who prefer active tracking and liquidity.

6. Fund of Funds (FoFs)

Fund of Funds invest in other mutual fund schemes, domestic or international.

⭐ Key Features:

-

Easy diversification across fund houses and geographies.

-

Suitable for investors seeking a ready-made portfolio strategy.

-

Expense ratios are higher due to layered structure.

-

Useful for international exposure without opening foreign accounts.

⬜ 7. Solution-Oriented Funds

Designed for specific long-term goals like retirement or child education.

Types:

-

Retirement Funds

-

Encourage retirement savings with longer lock-in periods (up to retirement age).

-

Higher equity allocation in early years, transitioning to debt later.

-

-

Children’s Funds

-

Help save for children’s education or marriage.

-

Lock-in for 5 years or till the child turns 18.

-

⭐ Key Features:

-

Goal-specific.

-

Encourages long-term disciplined investing.

-

Comes with lock-in periods and tailored asset allocation.

8. International or Global Mutual Funds

These funds invest in foreign stocks or mutual funds, enabling investors to diversify globally.

⭐ Key Features:

-

Exposure to international companies like Apple, Amazon, Google.

-

Protects against domestic economic slowdowns.

-

Affected by currency fluctuations and global market risks.

-

Ideal for advanced investors seeking global diversification.

How Do You Decide?

Choosing the right mutual fund depends on several personal factors:

-

Your investment goal (short-term liquidity or long-term growth)

-

Your risk tolerance (low, moderate, high)

-

Time horizon

-

Tax implications

-

Market awareness

Resourceful Links for Further Research

Final Thoughts

The world of mutual funds is vast and dynamic, offering something for every kind of investor. By understanding these categories in detail, you empower yourself to make informed financial decisions that suit your life goals.

Always read the Scheme Information Document (SID) and consult a financial advisor if you’re unsure.