Follow the Money: How Billion-Dollar Startups Really Make Profit

“Follow the money” is more than just a phrase—it’s a lens to understand how power, growth, and influence flow in today’s world. In the startup ecosystem, it helps us understand how unicorns—startups valued at over a billion dollars—go from burning cash to building profit.

The Billion-Dollar Illusion

Many startups hit billion-dollar valuations long before they make a single dollar of profit. But how do investors justify such valuations? It comes down to three key factors: scalability, disruption, and long-term monetization potential.

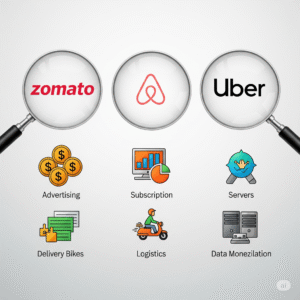

1. Uber: Monetizing Movement

Uber changed the way we move. It began with deep subsidies and massive losses. But eventually, Uber scaled and introduced tiers like Uber Premium, dynamic pricing, and partnerships with delivery businesses (Uber Eats). These diversified streams now help it inch toward consistent profitability.

2. Airbnb: Turning Homes into Hotels

Airbnb disrupted hospitality. Instead of owning properties, it profited by creating a global platform and charging service fees. Its business model scaled globally with low overheads. Today, it earns via bookings, cleaning fees, and premium experiences.

3. Stripe: Profiting from the Pipes

Stripe makes money every time someone swipes a card online. It earns a small fee per transaction and powers companies like Amazon, Shopify, and Instacart. Though it operates behind the scenes, its infrastructure-first approach generates recurring revenue that scales.

4. Zomato: Food, Data, and Delivery

Zomato began as a restaurant directory. It evolved by integrating food delivery, advertising, and subscription services. Its core profits now stem from restaurant ads, commissions on deliveries, and user insights it sells to partners. Despite competition, its hybrid model is yielding consistent revenue growth and operational leverage.

The Secret Sauce: Layered Revenue Models

What these unicorns have in common is not just growth—it’s layered monetization:

- Platform fees (Airbnb, Uber)

- Transaction margins (Stripe, Razorpay)

- Data monetization (Zomato, Facebook)

- Premium services (LinkedIn, Spotify, Canva)

What About the Burn Rate?

Initially, most unicorns lose money. This is intentional. They burn capital to acquire users and market share. The goal isn’t immediate profit but future cash flow domination.

Venture Capital’s Role

VCs fund early losses in return for long-term equity value. As companies grow, they optimize unit economics and aim for positive EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

Indicators of Real Profitability

- Improved Gross Margins

- Consistent Customer Retention

- Lower CAC (Customer Acquisition Cost)

- Positive Free Cash Flow

Lessons for Entrepreneurs

- Profit comes from scale: Startups must invest in acquiring users, then optimize monetization.

- Don’t rely on a single revenue stream: Layer your income sources.

- Watch your burn rate: Cash is king—especially in tough markets.

- Focus on real problems: Unicorns solve high-frequency, high-pain problems.

Final Thought: Money Reveals the Model

If you want to understand any billion-dollar startup, follow the money. It will tell you how they attract users, generate trust, and eventually, make a profit.

Resourceful Links

- Crunchbase – Track startup valuations and funding

- CB Insights – Unicorn startup statistics

- Business Insider India – Zomato and Indian unicorn analysis

- TechCrunch – Latest on startup earnings and funding

- Zomato Investor Relations

“If you follow the money, you’ll follow the value.”