AI in Personal Finance: Tools That Help You Budget, Invest, and Save

Artificial Intelligence is changing how we handle money. It is fast, accurate, and always available.

In 2025, personal finance is not just about spreadsheets. It is about smart tools powered by AI.

These tools help you budget better, invest smarter, and save more money with less effort.

Let us explore how AI makes personal finance easier for everyone.

What Is AI in Personal Finance?

AI stands for Artificial Intelligence. It means machines can make decisions like humans, using data and learning.

In finance, AI looks at your money habits. Then, it gives advice or takes action to help you.

It learns from your behavior and gets smarter over time.

This makes your financial life easier, faster, and more accurate.

Why AI Is the Future of Money Management

AI offers fast insights. It helps you avoid mistakes, saves time and even makes your money grow.

You do not need to be a finance expert. These tools do the hard work for you.

They use data, algorithms, and automation to guide your financial decisions.

Let us look at some top tools in budgeting, investing, and saving.

AI Tools for Budgeting

1. Cleo

Cleo is an AI chatbot that helps you manage your money using simple chat.

It connects with your bank. Then, it tracks spending, gives advice, and sets savings goals.

You can even ask Cleo, “Can I afford this?” It will give you a straight answer.

It is fun, friendly, and great for beginners.

2. YNAB (You Need A Budget)

YNAB uses smart budgeting rules and syncs with AI-driven bank data.

It shows real-time spending and helps you plan ahead. The tool guides every dollar.

The AI inside YNAB learns your spending style. Then, it gives tips to improve it.

Many users save thousands within months.

3. Emma

Emma is another AI-based app. It connects all your accounts in one place.

It tracks subscriptions, avoids overdrafts, and helps you plan spending better.

Emma’s AI alerts you before you overspend. That means fewer regrets later.

AI Tools for Investing

1. Betterment

Betterment is a robo-advisor. It uses AI to manage your investments based on your goals.

You tell Betterment your risk level and timeline. Then, the AI builds your portfolio.

It keeps your investments balanced. It also optimizes for tax savings.

Betterment is great for beginners and busy people.

2. Wealthfront

Wealthfront offers AI-driven investment advice. It manages your money with minimal fees.

It also helps with college savings, retirement, and even buying a house.

The AI adjusts your investments based on market trends. This helps reduce risk.

3. SigFig

SigFig uses AI to monitor your investment portfolio 24/7.

It finds low-performing assets. Then, it suggests better options or rebalances automatically.

You can link your accounts to it. SigFig then offers clear and smart insights.

AI Tools for Saving

1. Digit

Digit uses AI to analyze your spending habits. Then, it saves small amounts without hurting your budget.

You do not have to think about it. The app moves money into your savings automatically.

It feels like magic. But it is just smart algorithms doing their job.

2. Qapital

Qapital turns saving into a game. It uses AI to set fun rules like “save $5 every time I work out.”

You choose the rule. The AI watches and moves money accordingly.

Saving becomes automatic and enjoyable.

3. Albert

Albert uses AI to guide your financial health. It checks your spending, saving, and even bills.

Its AI finds money you can save and moves it for you. It also offers human advice.

You get a smart assistant and a financial coach together.

Benefits of Using AI in Personal Finance

- Saves Time: No more spreadsheets. AI tracks everything for you.

- Improves Accuracy: AI avoids human errors. Your numbers stay clean and updated.

- Boosts Savings: Many tools save for you automatically.

- Better Planning: AI can forecast future cash flow and warn you of trouble.

- Less Stress: You get clear answers and fewer surprises.

How to Choose the Right Tool

- Know Your Goal: Budgeting? Investing? Saving? Pick a tool that fits.

- Check Security: Your data must be safe. Look for encryption and bank-level protection.

- Try Free Trials: Many tools offer free versions. Try before you commit.

- Read Reviews: See what others are saying. User feedback is gold.

- Start Simple: Choose one tool and grow from there.

Common Myths About AI in Finance

Myth 1: AI Will Take My Money Without Asking

Truth: AI tools only move money with your permission. You stay in control.

Myth 2: AI Is Only for Tech Experts

Truth: Most AI tools use simple language. If you can text, you can use them.

Myth 3: AI Makes Mistakes Often

Truth: AI improves with use. It learns from data and corrects itself over time.

Myth 4: These Tools Cost Too Much

Truth: Many are free or low-cost. You often save more than you spend.

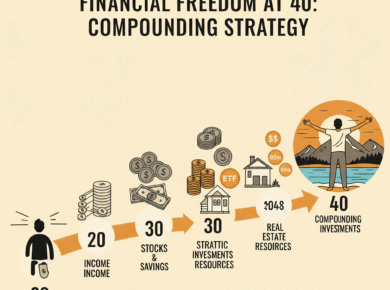

The Future of AI in Personal Finance

AI is only getting smarter. Soon, it will handle taxes, credit scores, and even debt planning.

Voice AI tools will talk to you and guide your choices.

You will have a personal finance coach in your pocket, 24/7.

Banks are also using AI to offer better loans and avoid fraud.

The future looks bright—and smarter.

Final Thoughts

AI tools for personal finance are no longer optional. They are essential.

They save time, reduce stress, and grow your money.

Pick one tool today. Let it help you build a better financial future.

Start small. Stay consistent. Let the AI do the heavy lifting.

Your wallet will thank you.

This is general blog only for education, what is available in market. Do not invest blindly. Take help of financial advisors before any investment.

1 comment

What you’ve written here is an invitation — to pause, reflect, and appreciate the deeper currents beneath the surface.