Top 5 Investing Books of all the time

Embarking on an investment journey requires not only capital but also a solid foundation of knowledge. The right books can provide invaluable insights, strategies, and perspectives that empower both novice and seasoned investors. Here are five essential reads that can significantly enhance your investment acumen:

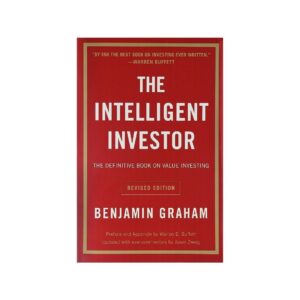

1. “The Intelligent Investor” by Benjamin Graham

Often hailed as the bible of investing, “The Intelligent Investor” introduces readers to the philosophy of value investing. Benjamin Graham emphasizes the importance of analyzing financial statements, understanding market fluctuations, and focusing on long-term investment strategies rather than speculative endeavors. Warren Buffett, one of Graham’s most notable students, has praised this work, stating it is “by far the best book on investing ever written.” Money – U.S. News & World Report+2Wikipedia+2The Ways To Wealth+2

Key Takeaways for investors:

-

The distinction between investment and speculation.Wikipedia+1Business Insider+1

-

The concept of “margin of safety” in investing.

-

Strategies to navigate market volatility without succumbing to emotional decisions.

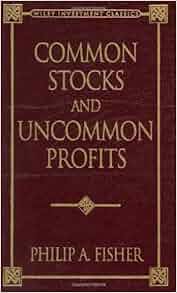

2. “Common Stocks and Uncommon Profits” by Philip Fisher

Philip Fisher’s work delves into qualitative analysis, focusing on understanding a company’s management quality, competitive advantages, and growth prospects. He introduces the “15 Points to Look for in a Common Stock,” guiding investors on evaluating potential investments beyond financial statements. This book is particularly beneficial for those interested in growth investing and understanding the nuances that drive a company’s success.

Key Takeaways:

-

The importance of thorough research and understanding a company’s operations.

-

Evaluating management’s integrity and capabilities.

-

Identifying companies with long-term growth potential.

3. “A Random Walk Down Wall Street” by Burton G. Malkiel

This classic text introduces the efficient-market hypothesis, suggesting that stock prices reflect all available information, making it challenging to consistently outperform the market. Malkiel advocates for passive investment strategies, such as investing in index funds, and provides a comprehensive overview of various investment vehicles. The book is renowned for its accessible writing style, making complex financial concepts understandable for readers at all levels. Moneywise+1Finbold+1Finbold

Key Takeaways:

-

Understanding the randomness of stock price movements.

-

The benefits of diversification and long-term investing.

-

Why low-cost index funds can be an effective investment strategy.

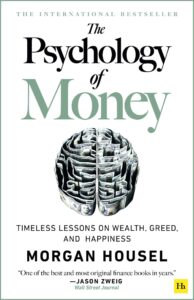

4. “The Psychology of Money” by Morgan Housel

Morgan Housel explores the behavioral aspects of investing, emphasizing that personal biases and emotions often play a more significant role in financial decisions than technical knowledge. Through engaging stories and anecdotes, Housel illustrates how individual experiences shape our financial behaviors and offers timeless lessons on wealth, greed, and happiness. This book is a compelling read for those looking to understand the human side of investing. Go Banking Rates+1InvestmentNews+1

Key Takeaways:

-

Recognizing and managing personal biases in financial decision-making.

-

The role of luck and risk in investing.Reuters+1RankRed+1

-

Strategies to develop a healthier relationship with money.

5. “Rich Dad Poor Dad” by Robert Kiyosaki

In this influential work, Robert Kiyosaki contrasts two differing approaches to money and investing through the stories of his “rich dad” and “poor dad.” The book challenges conventional beliefs about wealth-building, emphasizing the importance of financial education, investing in assets, and understanding the difference between working for money and having money work for you. It’s particularly effective in shifting mindsets towards proactive financial management. Business Insider

Key Takeaways:

-

The importance of financial literacy and education.

-

Understanding assets versus liabilities.Business Insider

-

The benefits of entrepreneurship and investing for financial independence.

Incorporating the wisdom from these books into your investment approach can provide a well-rounded understanding of both the technical and psychological aspects of investing. By learning from the experiences and insights of seasoned investors and financial experts, you can develop strategies that align with your financial goals and risk tolerance. Remember, while knowledge is a powerful tool, successful investing also requires patience, discipline, and continuous learning.

Read out more in finance section